by Thais | Dec 23, 2022 | KYC & AML

CDD MEANING: CUSTOMER DUE DILIGENCE What is CDD? The Customer Due Diligence meaning, often abbreviated as CDD, is a process that financial institutions, businesses, and other organisations use to gather information about their customers and clients in order to...

by Patricia Diez | Nov 14, 2022 | eIDAS regulation, AML5 and AML6, KYC & AML

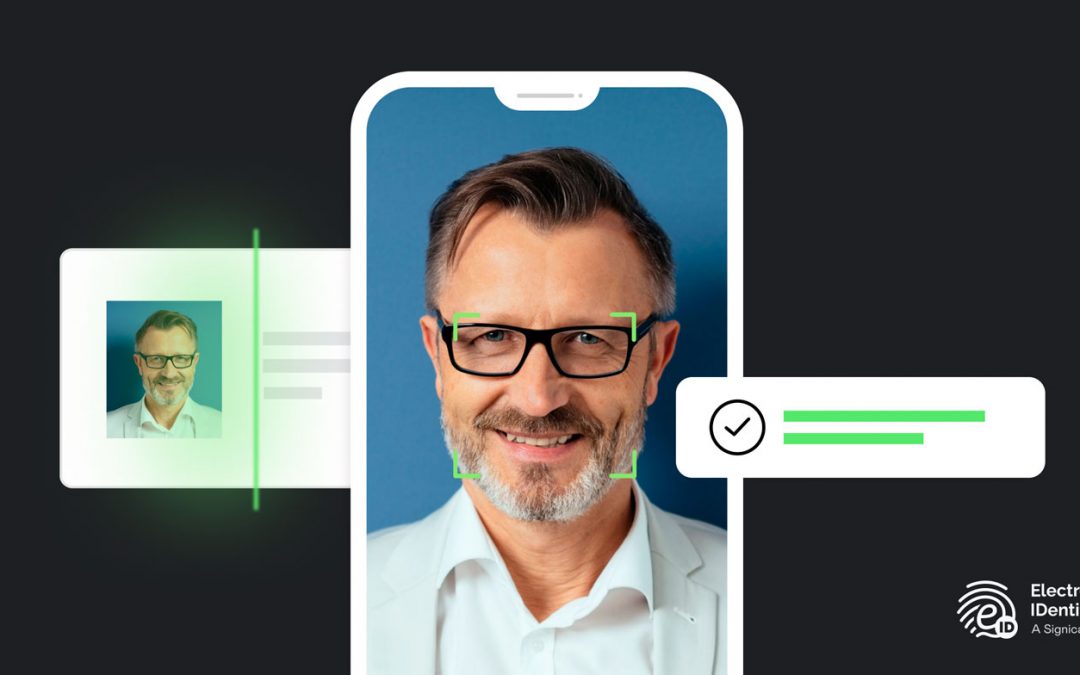

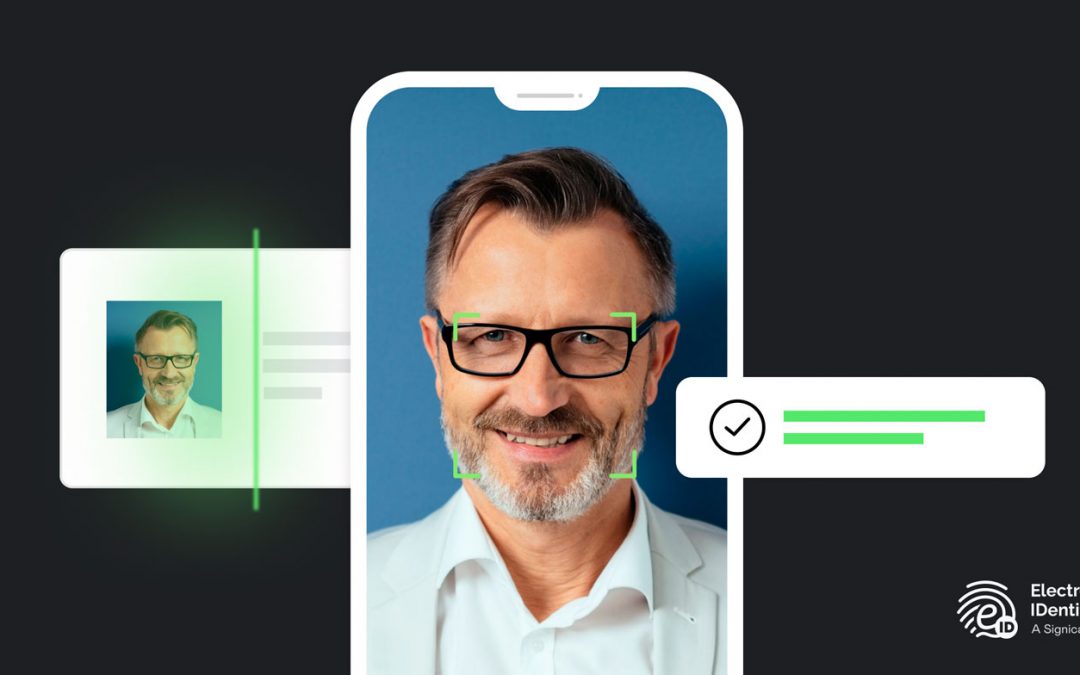

From some time on, the online identification solutions that allow customer identification by taking ID images of their documents and selfies for verification and identification purposes no longer comply with the regulations about money laundering and terrorist...

by Alex | Oct 14, 2022 | KYC & AML, Solutions

What is a bank account verification process and why do you need to verify your clients’ bank accounts? The bank account verification process is a process carried out by the bank at the time of opening a customer’s bank account. It allows all the necessary checks to be...

by Alex | Sep 29, 2022 | KYC & AML

The KYC (Know Your Customer) process is performed when a company or entity must know and verify the identity of the person with whom it interacts. For a company we will speak of a user or customer and for a public administration, for example, we will speak of a...

by Alba | Sep 22, 2022 | KYC & AML

(KYB) Know Your Business process is not so different from the most widely known and standardized Know Your Customer (KYC) process. The difference from KYC lies in the purpose and intentionality of the process, which is focused on identifying companies and suppliers....

by Patricia Diez | Sep 15, 2022 | KYC & AML

Probably, you have recently heard or read about the concept eKYC (electronic Know Your Customer or digital KYC). The needs of identification and user registration have increased with the transposition of the offer of products and services of all kinds to the online...