The use of chatbots in the banking sector is growing exponentially due to the development of more sophisticated conversational automatisation. A conversational chatbot can exchange information bidirectionally by text or voice through a bank’s mobile applications, guaranteeing the security of the data exchanged.

Although we are not yet at the point where talking to a robot is possible, conversational technology has certainly evolved, so much so that chatbots are getting better at simulating human-to-human interaction.

Thus, banks using chatbots can simplify their relationships with customers in general, especially for the onboarding process. The ability of digital banks to perform fastest, easiest, and overall better digital onboardings is one of the benefits of chatbots in banking, and the main reason why conversational chatbots are becoming increasingly popular with millennial and z-generation audiences.

What is the benefit of implementing chatbots in banking?

A chatbot in the banking sector is basically a software application that simulates a conversation by providing pre-established responses. They usually have a simple interface and are mobile-native, which allows them to be used anywhere: while traveling, walking, during lunch…

The conversational artificial intelligence used by chatbots in banking industry has been around for decades and is used to answer queries in real-time. However, for years the system was imprecise, very generalist, it did not use natural language, and the user needed to know a series of commands.

The development of artificial intelligence, machine learning, cross-platform integrations, and the latest advances in biometric recognition, have driven a vast improvement in user experience. Conversational chatbots, including the onboarding chatbot, nowadays use a language increasingly close to everyday speech and are able to recognise a wide range of different expressions that apply to the same transaction.

Find out more in this article on how to do one-click onboarding through a conversational chatbot.

Therefore, there are many potential use cases for chatbots in banking since they are prepared to be integrated with other search engines and applications, social media, and other artificial intelligence systems. This is what makes it possible for an onboarding chatbot to collect the users’ data privately in order to customise the customer experience as much as possible.

Added to this is the tendency towards humanisation. The response time (neither too fast nor too slow), the appearance, or the response style, which in some cases even includes humour, are factors that designers and programmers consider to make the interaction between human and chatbot more friendly and realistic.

The revolution of chatbots in the banking industry

One of the benefits of chatbots in banking is that onboarding chatbots enable greater efficiency in business-customer relationships, both in the daily recurrent operations and in the onboarding process, or even in the recommendation of products and services adapted to their specific needs.

Banks are using chatbots to make users’ daily operations easier and faster. There are many potential use cases for chatbots in banking that help improve users’ experience. On a day-to-day basis, digital banking users often perform simple operations such as checking account balances, making transactions or money transfers, or even onboarding. In onboarding operations, chatbots can help reduce the process to a simple conversation with an onboarding chatbot (in writing or by voice). In the case of less frequent operations, they also reduce the time required to search for commands.

Also, when recommending products and services, banks are using chatbots to recommend investment options, provide real-time market information or suggest financial products.

Potential use cases for chatbots in banking: the onboarding chatbot

There are many benefits of using chatbots in the banking sector and the creativity of companies creates a potential number of use cases that multiplies the uses and possibilities of conversational technology. These are just 7 benefits of chatbots in banking:

- Automation and acceleration of frequent processes. Some chatbots can help with everyday tasks by performing complex operations automatically such as analysing financial information in minutes.

- Personalised services. As a marketing tool, chatbots can collect information and create profiles of each user according to their use of digital platforms to offer the right products at the right time. This greatly improves conversion rates compared to generic advertising.

- 24-hour assistance anywhere. Customers no longer need to go to an office or wait to be attended to by phone at a specific time. A mobile application provides immediate assistance for their most frequent problems. For example, the onboarding chatbot.

- Internal training. Chatbots guide employees in the implementation of new processes, products, or technologies, update their security knowledge, remind them of corporate policies, provide technical assistance or train new staff during their adaptation.

- Measuring customer satisfaction. One of the most frequent tools is to close the conversation with questions about the experience to improve existing solutions.

- Increased productivity and efficiency. The use of the application implies a reduction in costs for the bank by reducing the time spent on both data processing and customer service.

- Financial education and guidance. To solve one of the biggest challenges in the relationship between banking and society, technologies can be used to help manage finances and teach basic concepts at any time and in a personalised way.

Find out more about digital onboarding in the banking sector in this article.

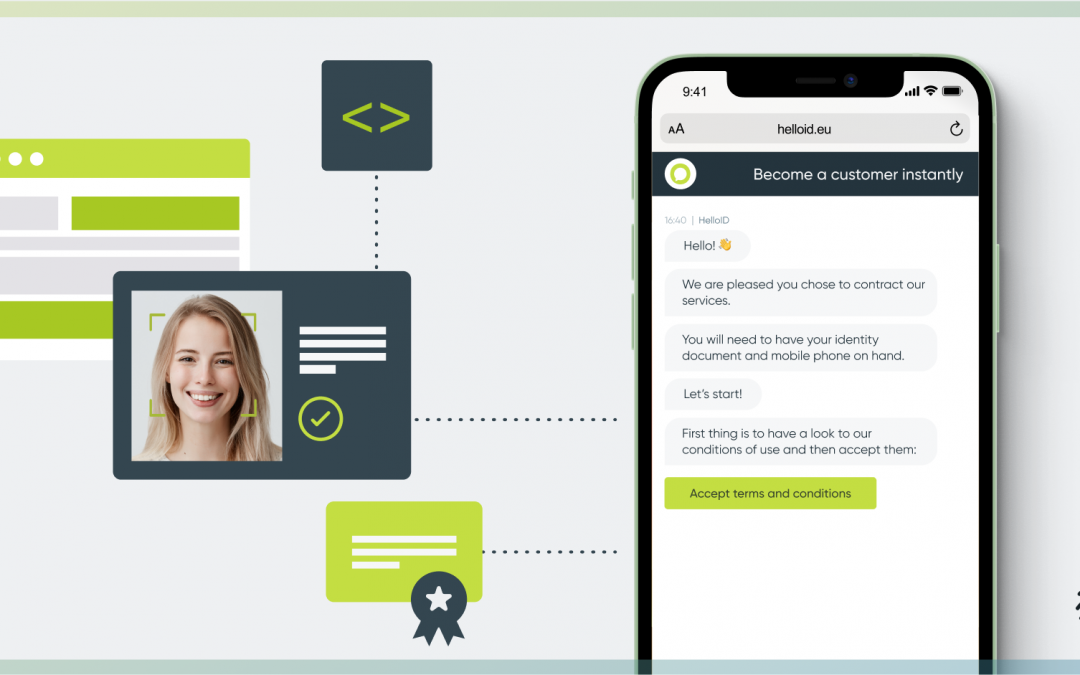

Conversational banking chatbot: the HelloID example, best chatbot for onboarding

Advances in biometric recognition and authentication systems work seamlessly in sync with the chatbots in banking industry, speeding up access times to digital platforms and product ordering.

The biometric verification solution in the HelloID chatbot framework for onboarding is an excellent example of how different technologies come together in a single system to make it easier for both bank employees and customers. This makes HelloID one of the best banking chatbot examples.

The facial recognition system offers a unique user experience from any channel and verifies identity according to KYC and AML standards. Within seconds, the customer’s video image is captured and processed. The time reduction results in higher customer satisfaction and increased efficiency in customer acquisition processes.

Don’t waste another minute and request a free demo of HelloID by clicking here.