An overview of the webinar “Don’t Trade Growth for Compliance”, happened on June 15, 2022, which featured the industry experts in the crypto and legal fields:

- Koen Vanderhoydonk – CEO & Founder of “The Connector”

- Joaquim Matinero – Banking-Financial & Blockchain Lawyer at Roca Junyent

- Esther Makaay – elD Specialist at Signicat

Access the replay here and watch the entire webinar.

Overall Perspective

The relationship between the crypto industry and compliance has been in the air over the last few years with regulators and crypto parties discussing how to make it come to fruition. So, before giving a view of what the future holds, it is important to look at the present situation and understand what is happening.

Considering this, the question “Why do we do compliance?” arises undoubtedly. The answer can be as simple as the fact that complying is part of being a member of a globalised society where people live and work together. Consequently, financial crimes such as money laundering and terrorism financing must be addressed and prevented.

Organizations across the world are using existing financial, digital, and banking infrastructure to conduct money laundering, which is a trillion-dollar organised crime industry. Thus, financial institutions must ask themselves what they can do to protect their businesses from financial crimes. There are four elements of compliance that institutions need to be aware of:

First element – Know Your Customer (KYC)

This is the most simple and basic element of compliance. In response, regulatory bodies and crypto companies from around the world sought to find out who they were doing business with and who they were allowing into their trading platforms. To help with this, KYC has now been mandated all over the world as part of the onboarding process for crypto exchanges under different jurisdictions.

Second element – Framework & Law Enforcement Units

When financial institutions identify the identity of their customers, they are going to be needing a national law enforcement framework. It is because in the event financial institutions identify criminals or criminal behaviour, they will hand them over to the law enforcement agencies who will be able to take further action as necessary.

Third element – Technology

Technology comes into play when we talk about Know Your Customer (KYC), Know Your Business (KYB), Know Your Transaction (KYT) and Regulatory Reporting. Large organisations and businesses are using technology to comply with regulatory requirements as efficiently and cost-effectively as possible.

Fourth element – People

Traditionally, it has been known as the three lines of defence in banks. In the context of anti-money laundering risk management (AML), the “Three Lines of Defense” is a widely used phrase that describes how organizations should manage their AML risk. Customer onboarding, account activity, and ownership structure are tasks for the first line of defence. Monitoring and coordinating the organization’s compliance program and reporting suspicious transactions are the responsibility of the second line of defence. To maintain the third line of defence, it is necessary to have an independent testing team.

Download the AML & eIDAS report and discover the two most important regulations affecting Europe’s financial and crypto industry.

How Is the Crypto Industry Evolving?

“Crypto in my opinion is also like financial institution” Vanderhoydonk adds while explaining that when the crypto industry first emerged, it was used for purely transactional purposes. Dirty schemes such as money laundering were rare. This is because there was a lot of volatility and uncertainty in the system at the time.

Stable coins, on the other hand, were introduced shortly thereafter that maintained their value in spite of the overall crypto market fluctuations. As a result of stable coins and the confidence and stability that they added to the market, more money launderers entered the market.

Around the world, there have been numerous cases of crypto stolen from crypto exchanges and other crypto companies, both of which have been tracked by law enforcement agencies. This is due to the fact that all transactions on the blockchain can be traced and tracked.

The most fascinating aspect is that younger generations are more interested in crypto and very well versed in basic financial concepts like buy low, sell high, hedging, futures, and other derivatives. A fast spread of financial literature among the younger population could not have been possible before crypto. Moreover, younger generations invest and trade cryptocurrency in an unprotected environment, which means they are either lured into buying certain tokens by influencers or are impacted by tweets and market commentary. That’s why MiCA exists.

MiCA & NFTs

In the EU, the Markets in Crypto-assets Regulation (MiCA) specifies how crypto-assets not covered by the existing financial services legislation should be regulated, providing a solid regulatory framework to create crypto-asset markets. By creating a framework to issue crypto assets as well as provide services related to such assets, MiCA will foster innovation and fair competition.

Additionally, it aims to ensure that consumers and investors are protected, as well as address financial stability and monetary policy risks associated with widespread use of crypto-assets and advanced DLT-based solutions. Last but not least, the MiCA includes actions against market manipulation and measures against illicit activities such as money laundering, terrorist financing, and criminal activity.

In the EU, currently most crypto assets are outside the scope of EU financial service regulation. MiCA recognises crypto assets as one of the largest applications of blockchain technology in finance.

MiCA – Cryptocurrency providers

Cryptocurrency providers must be legal entities with registered office in the EU and be authorised by the competent national authority. They should have their activities approved by regulators prior to commencing their operations. The services could include:

- Custody on behalf of third parties of crypto assets or access to crypto assets

- Operations of a trading platform

- Exchange of crypto against fiat or vice versa

- Receipt and transmission of orders related to crypto assets

- And many other services…

It has been announced in the latest draft of MiCA that the European Parliament has designated ESMA, the European Securities and Markets Authority as the top cryptocurrency regulator of the region. In addition to licensing crypto-related institutions and exchanges, the European organization would also supervise national regulators in the field of crypto-currencies.

NFTs – Introduction

Since the $69,3 million purchase of a digital artwork in 2021, NFTs have become a buzzword in the art community and beyond. NFT stands for Non-Fungible Token. Purchasing NFTs make you “owner” of the item they point to.

Since NFT tokens are unique, they cannot be exchanged for any other tokens of a similar nature. NFT tokens typically run on the Ethereum blockchain. NFTs have certain characteristics that include:

- Strangely Unique

- Non-interoperable

- Indivisible

- Indestructible

- Verifiable

It is important to mention here that MiCA does not cover or address NFTs in its legislation at this moment.

So, You’re Being Regulated?

In recent days, the European central bank has been active and in the news against crypto companies violating digital and cryptocurrency regulations. “It really looks like Europe is going to put severe regulations on these,” says Esther Makaay while talking about cryptocurrency.

The AML Laws And Standards

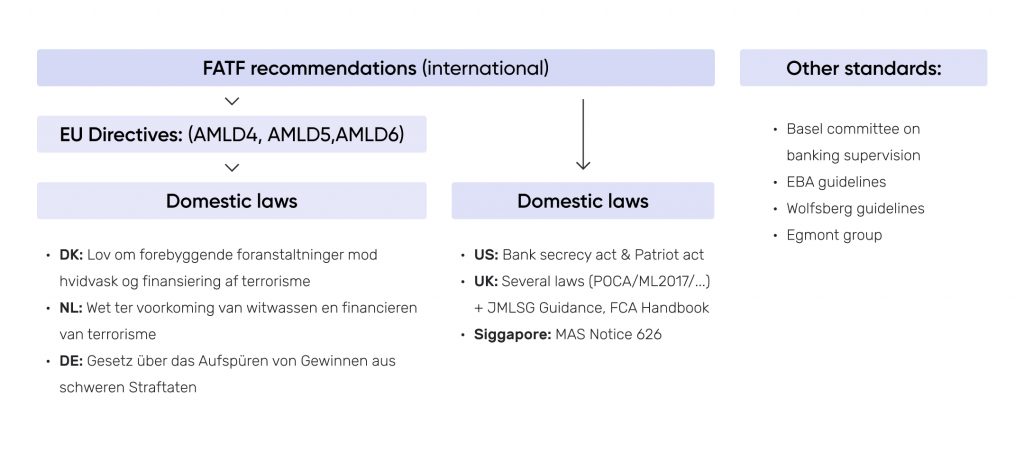

The Financial Action Task Force (FATF) Recommendations increase transparency and facilitate effective actions against the illicit use of financial systems. They are international standards against money laundering and terrorist financing. Countries around the world including the EU take guidance from FATF-issued standards. The latest EU AML Directive complies with FATF requirements due to this reason.

The US, the UK, Singapore and other countries comply with FATF recommendations based on the requirements specific to their country and have enacted appropriate AML legislation.

AML/CDD/KYC Regulations

For companies based in Europe, AML regulations are essential to ensure they do not get into legal trouble with EU authorities. The concept of compliance is not limited to KYC. Businesses must understand other elements of compliance as well. Generally, this will include complying with the sanctions lists so that your business does not have any dealings with members of criminal or terrorist organizations.

Businesses must routinely review their customer profiles and report any suspicious behaviour to their respective FIUs.

The Battle to Onboarding History

The common thread in digital onboarding is your customer. Identifying who they are and understanding what drives their behaviour are crucial.

Signicat has been conducting surveys among the customers of its financial institutions since 2016 and asking consumers what their onboarding experiences are. Shocking results were revealed.

- 68% have abandoned onboarding for financial services up from 40% in 2018. This trend is getting worse when viewed from a macro perspective.

- 75% between 18-34 have abandoned financial onboarding.

- Abandonment rates by Spanish consumer are 6th highest.

- Moreover, 64% of consumers mention the importance of cross-border identity credentials.

You Need an Onboarding Strategy

With regulations constantly evolving, organisations (including crypto exchanges) have to step up their onboarding strategy. Organisations should not just wait to be fined before complying with regulations. They should proactively comply with them. Although these are not without their challenges. Challenges when creating a digital onboarding process include AML KYC compliance, conversion rates, good user experience, cost control, etc.

You need Electronic IDentification

Electronic IDentification’s technology and solutions have been designed for organisations keeping in mind the challenges they face on an ongoing basis. Long-term partnership in technology and compliance with the aim of getting ahead of what needs the future regulations may arise, and with solutions of high scalability, cross-border, seamless integration, world-class AML KYC compliance, and developer-friendly functionality.

Electronic IDentification, Regtech Partner for Crypto Exchanges

Electronic IDentification works with clients in the crypto sector to promote a blockchain KYC solution and keep the crypto exchange platforms from a safe, guaranteed, and quality perspective.

Our different levels of VideoID, eSignatures, and Facial Biometric Authentication services are transforming the way in which companies and customers interact. Current eKYC solutions, powered by Artificial Intelligence and Machine Learning allow businesses in any sector, such as banking, insurance, financial and investment services, to be digitally transformed, reduce digital customer onboarding costs and grow by offering a unique user experience.

Electronic IDentification is therefore committed to the definitive impulse of the crypto exchange sector and KYC blockchain use cases but also to develop solutions to enhance its expansion through scalability with advanced customer acquisition tools both at the normative and regulatory level as well as commercial improvement.

Learn more about Electronic IDentification solutions with our expert in Digital Identity and compliance Satomi Ortega in our recorded webinar.