Although the already widely known advantages and benefits of 100% digital and remote customer onboarding, many users still go to a commercial office, branch or store to carry out certain types of operations. These users perform formal and bureaucratic matters rather than day-to-day issues.

One of these formal issues is the signing and contracting of products and/or services, which requires identity verification and specialized hardware.

The digital electronic signature process

The electronic signature process basically consists of the unequivocal linking and joining of a signatory’s identity data with a specific text or document. In this way, the signer accepts with full integrity and legitimacy the content of the document.

This process is common and necessary both in the banking and financial sector and in other sectors. Traditionally, the simple method of a graphic signature on paper had been used, with its subsequent scan and photocopy of ID. However, this method is tedious and carries an increased risk of falsification, spoofing, and data loss.

Digitization and current regulations (eIDAS) have allowed the electronic signature, with all its advantages and versatility, to be standardized and integrated into the daily activities of signing and accepting documents and texts. In this way, the verification of the identity of the signatory is now more secure and guaranteed.

In-depth learn in this article about Advanced Electronic Signature and how other types of electronic signature work.

Why integrate the signing process into ATMs and digital terminals

ATMs and digital terminals or POS terminals are a fast, agile, entertaining and non-intrusive way of reaching a certain audience in specific spaces such as shopping malls, busy streets or strategic points of interest. The user can approach them not only to withdraw money, but to check the company news, obtain information, contract new products and services or register as a client in the case of not being one yet.

Many users feel rejection when a commercial urges them to become customers or adhere to certain products or services. However, this new method allows user’s initiative and autonomy. The user can comfortably check information in the terminal without the pressure of a commercial agent.

A well-signalled terminal with the appropriate hardware and software can be an excellent new channel for new customers to sing up or to carry out existing customers’ business by hiring new products and services. This audience, difficult to reach through other channels and commercial methods, can feel comfortable and motivated with this process in digital terminals and ATMs.

Loyalty can be improved thanks to a new quality experience and with the best design, tailored to customer needs and with which they can quickly and comfortably solve tasks that were once tedious and complex.

With the rise of, for example, cinema and series services on demand, we have seen how users are increasingly requesting autonomy and choosing time and place to access their products. The need for appointments with managers or commercials, the wait in endless queues and the excessive paperwork is now history thanks to the integration of the electronic signature in the devices of the company’s network.

Check here our solutions for both online/remote channel and point of sale.

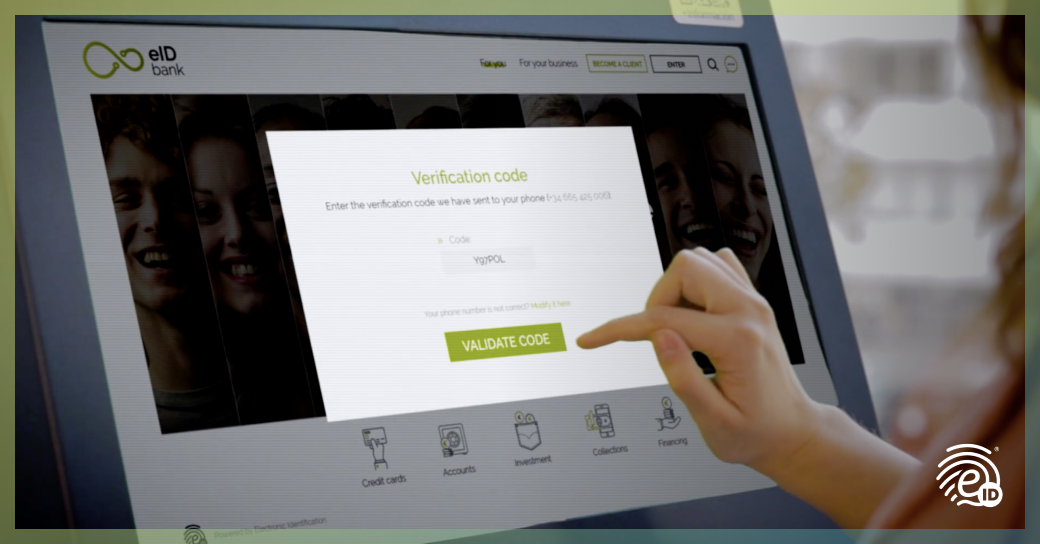

How the signature works in ATMs or terminals with OTP

Many of the tasks and contracts by the client will require the electronic signature of documents in the ATMs or digital terminals. It is a simple process that will only take a few seconds to complete:

1. The document to be signed is shown to the previously registered user at an ATM, terminal or POS.

2. The user reads the document and clicks on the “sign” button.

3. The user receives an OTP (One-Time Password) by SMS on their mobile phone and enters it into the application.

4. The document has been electronically signed with an electronic certificate of a natural person and a qualified time stamp.

This process is totally safe and legal since it is based on the previous identification that was made of the user’s identity when he was registered by the company for the first time. The electronic signature process at ATMs fully complies with eIDAS (electronic IDentification, Authentication and trust Services) regulation.

Download this complete guide on eIDAS and AML5 for free.

SignatureID, revolutionizing the banking sector

SignatureID adapts by a simple configuration to any case of signing and contracting. It is the comprehensive electronic signature solution of Electronic IDentification, eID. A versatile and omnichannel solution that works with simple, advanced and qualified electronic signature.

It performs the highest level of security and complies with the most demanding regulations on digital identity. It uses x.509 v3 electronic certificates and has been implemented with the PadES standard, with a qualified electronic time stamp.

Apply now for a free 15-day trial of SignatureID using this form.