What is a bank account verification process and why do you need to verify your clients’ bank accounts?

The bank account verification process is a process carried out by the bank at the time of opening a customer’s bank account. It allows all the necessary checks to be carried out on the holder and the origin of their income, thus effectively preventing criminal actions such as money laundering or the financing of terrorism.

In this article, we will look at how to verify a bank account and its holder, as well as the regulations to be taken into account to properly carry out the verification of a client’s bank account.

First, the bank account verification process starts by verifying the account holder’s identity. As we know, this process takes place during the onboarding of a user and can be carried out in two ways:

- In-person bank account verification process: To verify your clients’ bank accounts in person, they must go to a branch or commercial office and ask to open a bank account. There, an agent will carry out the necessary checks on the account holder (identity, copy of ID card or passport, address, that they are not on any list of fraudulent persons, etc.) and will open the bank account after verifying that the details provided are valid.

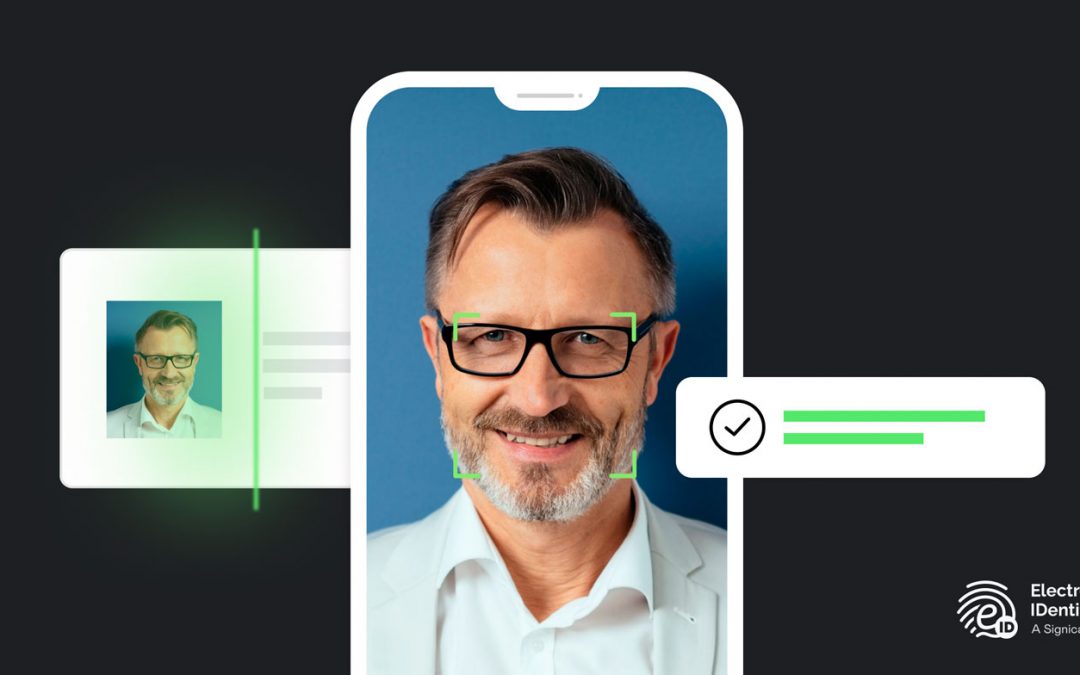

- Bank account verification online: Here, we are talking about digital onboarding, which is becoming increasingly common in the banking sector. The user does not need to go to a branch or speak to an agent. They can carry out the verification and account opening process online through a 100% digital and automated registration and identification process that will ask them to verify their identity document (passport, ID card…), their identity, and proof of life.

The process of identity verification at the time of opening a bank account is a requirement that banks and companies belonging to regulated sectors, such as insurance companies or telecommunications companies, must follow to comply with AML regulations. This regulation, which follows common standards in the EU, helps to prevent money laundering and terrorist financing.

Download here the complete guide to AML regulation to ensure full compliance to verify a bank account.

How do you verify a bank account?

Banks must verify bank accounts and their holders to avoid identity theft or money laundering. As indicated in the 6th AML Directive, the annexe to the 5AMLD, which specifies the fines for non-compliance and other liabilities, in these crimes, not only the person who has committed it gets punished but also the banks or regulated entities involved in it for failing to detect such fraud.

As indicated in the AML5 regulation, to which all regulated sectors such as banks or insurers must adhere, they must implement all necessary mechanisms to prevent money laundering, fraud or identity theft. Consequently, the most critical step is to verify the bank account holder’s identity and establish secure, unique and unbreakable access to the bank account assets.

Therefore, at the time of transactions, banks also should verify the bank account belonging to another bank (given the case). This interbank collaboration guarantees a correct bank account verification system and the different transactions carried out between them.

There are several bank account verification APIs for the verification and integrity check of bank accounts. In addition, online bank account verification softwares also verify the bank account holder’s details, the account’s origin, the bank’s branch to which it belongs, etc.

These bank account verification tools must be integrated into each one of the banks’ processes.

Bank account verification online and its relation to KYC

Among all the processes and software that banks must put in place for bank account verification, Electronic IDentification offers API that support the KYC process in banking (Know Your Customer) during the digital onboarding of users and their subsequent authentication.

With this, Electronic IDentification offers various tools of KYC to verify a bank account at the time of its opening:

- QES+: The most comprehensive bank account opening and verification solution on the market. It enables real-time identity verification through video identification followed by a qualified electronic signature—the only face-to-face equivalent on the market.

- VideoID: Unique real-time video identification solution based on artificial intelligence and machine learning, which complies with AML5 and eIDAS and is equivalent to face-to-face identification.

- SmileID: Complementary solution to verify the identity of bank account holders to authenticate themselves through a facial biometrics system.

- SignatureID: A comprehensive solution for simple, advanced and qualified electronic signatures for all types of documents and contracting or digital signature needs.

Request a free demo now and try the most advanced online identity verification process.