Digital terminals are known as one of the most unique media within those for user relationship. We have been noticing how these devices are located in certain strategic points so that the user can check information or perform some specific actions.

In this use case, we will delve into how these devices have specific characteristics that make them ideal for processes such as bank account opening.

What are digital terminals

Digital terminals, also known as POS (Point of Sale) or touch screens, are devices with the aim of facilitating sales in specific commercial locations.

We can categorize this type of equipment in two variants:

- Those for exclusive use by store, commercial or branch staff.

- Terminals intended for customers or potential customers use.

The first one is not usually attractive and assists the employees of the establishment to carry out all the relevant actions in relation to sales and direct customer service.

However, we can increasingly see how shopping centres, bank offices or other types of stores are placing large touch screens aimed for autonomous use by the customer.

Check here the use case on advanced solutions for ATMs.

These units are perfect for reducing waiting times while giving the customer a feeling of freedom, being able to decide if they prefer to carry out the procedures through the terminal or approach and ask the business staff.

Digital terminal identification applications

Digital terminals hold dozens of different applications depending on the needs of the company or place for which they have been raised. From checking information on products and services already contracted or not, to placing orders or managing appointments, complex procedures can be carried out on these devices.

With regard to carrying out tasks that can be considered as delicate, such as opening a new bank account, due to its complexity and the necessity to comply with a series of AML checks, risk prevention and regulatory security, the terminal must be equipped with specialized software for this process.

Facial biometrics and video identification are the safest, most reliable and efficient methods for this type of procedure. The KYC (Know Your Customer) process, necessary for opening a bank account, can be carried out easily on any digital terminal thanks to its digitization (eKYC).

How the registration process works in a digital terminal

The process is very similar to the well-known and standardized VideoID process that is carried out remotely to open bank accounts online. The difference lies in the device and in that a commercial agent can help the customer on-site during the process.

Although the help and assistance from a branch or location agent is a great advantage, this is not expressly necessary since the process has a quality user experience and is led by a step-by-step narrator:

- The customer approaches the terminal.

- He chooses the option from the menus to “create a bank account.”

- You are informed that your identity must be verified to proceed with the registration and account opening.

- Customers are asked to enter their data.

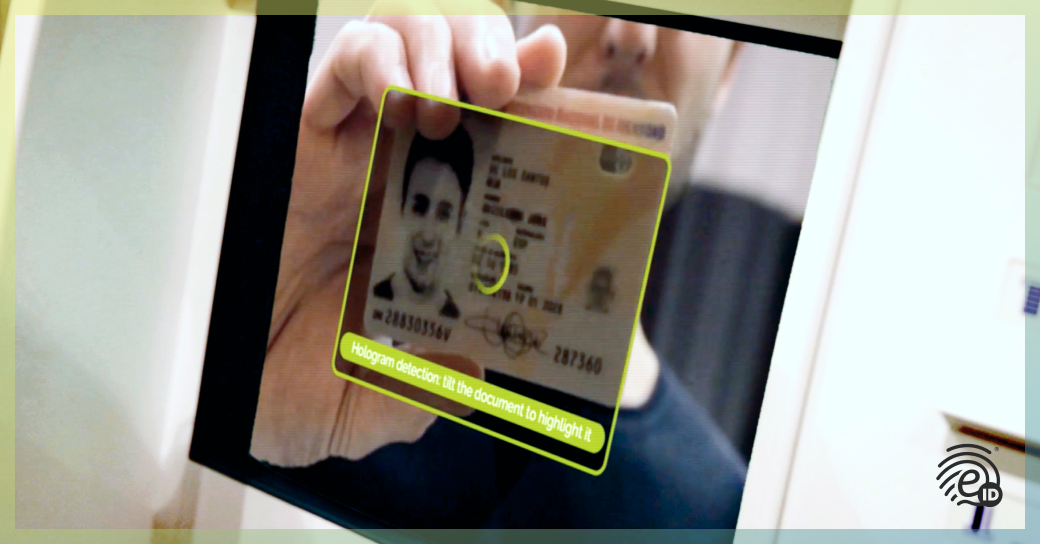

- The customer shows his identity document on both sides, which is registered in the system and its authenticity is validated.

- Subsequently, he smiles at the camera and a biometric comparison is performed with more than 21 security measures in real-time through a 30-second video-assisted by artificial intelligence.

- The process is time-stamped and the account can be created in the name of the customer newly registered.

The video can be sent asynchronously for validation by a certified agent, providing an extra level of security. However, the video identification process already complies with the most stringent regulations such as eIDAS and AML5.

Download here for free the ebook on AML5 and eIDAS, the standard regulations for online account opening.

This solution provides an omnichannel experience that serves to authenticate the client through any device with a camera so that they can access the products and services contracted.

VideoID, innovating in the financial sector

VideoID, the most complete video identification solution, can be easily integrated into any type of device with internet access, including digital terminals.

It allows to completely digitize the customer acquisition process in any sector and channel, especially in the banking, financial and insurance sectors. It complies with current regulations on this matter and boasts a unique user experience with the highest level of technical reliability and security.

Request here a free VideoID demo.